When employment ends, what follows matters more than many realize.

For an employee, a full and final settlement represents closure. It answers one simple question: Have I been paid correctly for everything I earned?

For an employer, it represents responsibility. It ensures financial obligations are settled, labor laws are followed, and legal risks are avoided.

In India, full and final settlement is not optional. It is legally required, time-bound, and documentation-driven. A single mistake can create dissatisfaction, trigger disputes, or damage an employer’s reputation.

This guide explains full and final settlement rules, the FnF settlement process, components, timelines, and responsibilities — clearly and practically — from both employee and employer perspectives.

What is a Full and Final Settlement?

Full and final settlement is the process of settling all dues when employment ends.

It applies when an employee resigns, retires, or is terminated. The settlement ensures every unpaid salary, benefit, and deduction is calculated, documented, and paid.

From an employee’s view, it confirms the final payment is accurate.

From an employer’s view, it ensures legal compliance and proper closure.

What Full and Final Settlement Includes

- Unpaid salary until the last working date

- Leave encashment for unused earned leave

- Final settlement payment of eligible benefits

- Provident fund contributions as per rules

- Deductions for applicable taxes and recoveries

Each element has a defined function and value.

Final Salary Inclusion: What Exactly Gets Paid?

The biggest question in any final settlement is simple. What counts as the final salary?

For employees, this section creates clarity. For employers, it reduces disputes and protects the employer’s reputation. The final salary usually includes earnings up to the last working date, plus eligible payouts. It excludes amounts that are not applicable under company policies.

It is important to treat the final salary as the base component. Other components like leave encashment, reimbursements, and deductions sit on top of it.

What Final Salary Commonly Includes

- Unpaid salary is calculated until the employee’s final working date

- Pending salaries include approved incentives earned during the active employment period

- Final salary includes allowances as per company policies and structure

- Salary calculation uses attendance data and approved employee leaves

- The total amount depends on the settlement timeline and the applicable rule

Why Full and Final Settlement Matters to Both Sides

FnF is not only about money. It is about trust.

Employees expect clear communication, correct calculations, and timely payment. Employers must protect themselves from disputes, penalties, and legal risks.

When handled poorly, FnF can create dissatisfaction. When handled well, it supports a smooth exit and preserves relationships.

Risks of Poor FnF Handling

- Delayed payments damage employee trust and morale

- Incorrect calculations create disputes and legal risks

- Missing documentation weakens the employer’s defense later

- Non-compliance harms the employer’s reputation significantly

Accuracy is not optional.

Full and Final Settlement Rules in India

India’s labor framework defines strict rules around final settlement.

These rules protect employees and guide employers. Ignoring them exposes organizations to penalties and litigation.

Key Laws Governing Final Settlement

- The Payment of Wages Act mandates a timely final payment

- Income tax law governs applicable taxes on settlement

- The Gratuity Act defines eligibility and calculation rules

- The EPF Act regulates provident fund contributions

Settlement must occur within the stipulated period, often ranging from 2 to 45 days depending on circumstances.

FnF Settlement Process: Step by Step

The FnF settlement process follows a defined structure.

Each step ensures financial accuracy and documentation completeness.

Steps Involved in FNF Settlement

- Employee leaves the organization through resignation or termination

- Notice period served or adjusted according to company policies

- Leave balances frozen and verified by HR

- The finance department calculates the final settlement components

- Applicable taxes and deductions are applied

- Final settlement payment is processed and paid

Each step must align with law and policy.

Major Components of Full and Final Settlement

Every final settlement is a combination of multiple components.

Each component has a formula, value, and rule.

Salary and Pending Salaries

Salary is the core component of any full and final settlement. It represents the money an employee has already earned but has not yet received.

For employees, this section confirms they are paid for every day actually worked. For employers, it ensures there are no unpaid wage liabilities left open after exit.

The final salary is calculated only up to the employee’s last working date, not the resignation date. If salary for earlier months is pending due to payroll cycles, approvals, or delays, those amounts must also be added to the settlement.

Salary calculation is not estimated. It is strictly based on verified attendance data, approved leaves, and the employee’s employment records.

What Salary and Pending Salaries Include

- Salary calculated till the employee’s final working date

- Includes unpaid salary from previous payroll cycles, if any

- Covers approved allowances as per the company’s salary structure

- Based on attendance data, leave records, and shift policies

- Forms the base amount for full and final settlement calculation

If this step is inaccurate, the entire settlement becomes incorrect. That is why payroll systems like Bharat Payroll rely on locked attendance data and policy rules before calculating salary during FnF.

Leave Encashment: Meaning, Formula, and Practical Example

Leave encashment is a major component of full and final settlement. It is also one of the most common reasons for dispute.

Employees want fair payment for unused earned leave. Employers must follow company policies and maintain proper documentation. The formula usually depends on how your organization defines the per-day salary value.

Leave encashment becomes complex when leave balances are not updated or when attendance data is inconsistent. That is why automation matters.

Leave Encashment Formula

- Leave balances multiplied by per day salary value equals encashment

- Earned leave is paid if eligible under company policies

- Leave encashment uses the salary structure rules and the applicable formula

- Leave encashment is determined before applicable taxes and deductions

- Correct leave balances prevent disputes and create a smooth exit

Simple Example for Clarity

If the earned leave balance is 10 days, and the per-day value is ₹1,500, then leave encashment equals ₹15,000. This value is added to the final settlement payment, subject to applicable taxes if required under income tax rules.

Provident Fund and Other Benefits

Provident fund and statutory benefits are governed strictly by law. They are not discretionary.

For employees, these benefits represent long-term financial security. For employers, they are mandatory financial obligations under Indian labor laws. Any error in handling provident fund contributions can lead to penalties, audits, or employee complaints.

Provident fund contributions are calculated only up to the employee’s last working date. Employers must ensure both employee and employer PF contributions are deposited correctly and reported within statutory timelines. Gratuity, where applicable, must also be processed based on tenure and eligibility rules.

Other benefits, such as insurance-linked payouts or role-specific benefits, are paid only if defined in company policies. Every benefit included or excluded must be clearly documented to avoid confusion.

What the Provident Fund and Benefits Include

- Provident fund contributions processed as legally applicable until the last working date

- Gratuity paid if tenure conditions are satisfied under applicable laws

- Other components are paid strictly as per company policies

- Statutory benefits are calculated independently of final salary amounts

- All benefit payouts must be clearly documented in settlement records

Clear documentation protects both sides.

Notice Period and Recoveries

Notice period handling is one of the most misunderstood parts of full and final settlement.

For employees, it determines whether their salary is reduced. For employers, it ensures operational continuity and fairness. The notice period must be evaluated exactly as stated in the employment agreement.

If the employee serves the full notice period, no recovery applies. If the notice period is partially served or waived, the shortfall amount must be calculated accurately. Any recovery should be adjusted transparently in the final settlement payment.

Ambiguity in notice period calculations is a common cause of disputes. Clear rules and written explanations prevent arguments.

How Notice Period and Recoveries Are Handled

- Notice period served or buyout calculated accurately as per the contract

- Recovery applied if a notice shortfall exists

- Recovery amount adjusted in the final settlement payment

- Calculation based on the salary structure and notice clause

- Clear communication prevents employee dissatisfaction and disputes

Precision avoids conflict.

Reimbursement Claims and Other Payments

Reimbursement claims are not automatic. They must be verified before inclusion in the final settlement.

For employees, this ensures legitimate expenses are reimbursed. For employers, it prevents financial leakage and audit issues. Only approved claims with valid receipts and managerial approval should be processed.

Unverified or late-submitted claims cannot be included in the final settlement. This is why reimbursement closure should happen before the employee’s last working date whenever possible.

Documentation is critical because reimbursement claims are often reviewed during audits and internal checks.

How Reimbursement Claims Are Processed

- Approved reimbursement claims are included in the final payment

- Claims verified with receipts and documented approvals

- Unverified claims excluded from settlement calculations

- Reimbursement data is reviewed by the finance department before payout

- Proper documentation prevents disputes and audit issues

Verification ensures fairness.

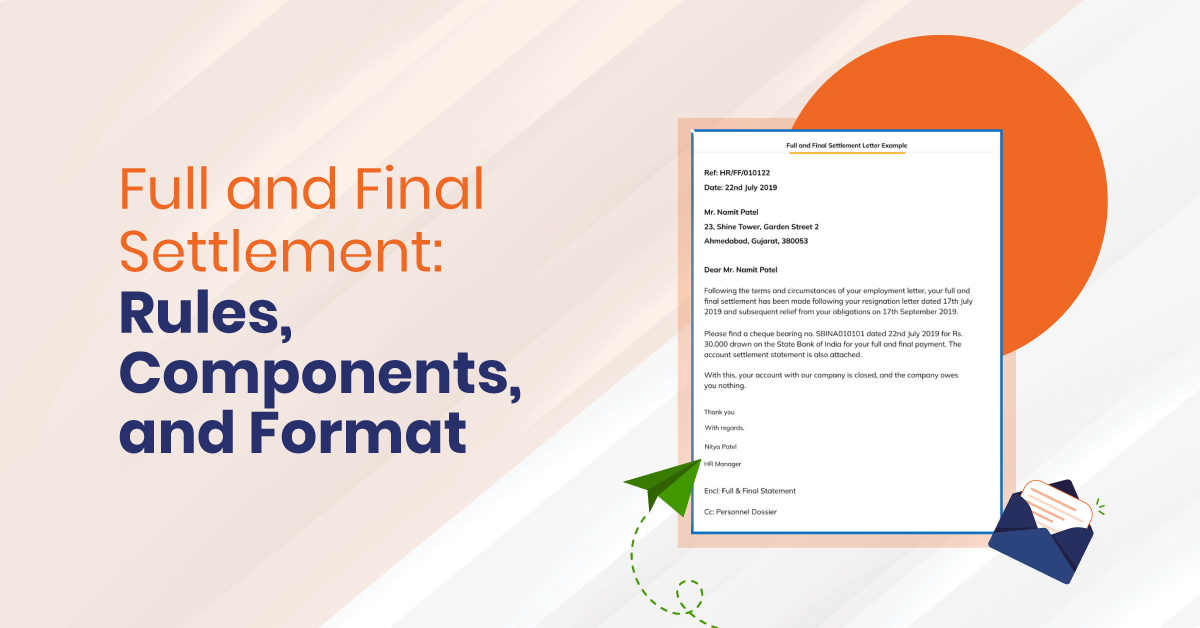

Final Settlement Format and Documentation

Final settlement must follow a clear format.

The format ensures transparency for both employer and employee.

Proper Documentation Required

- Full and final settlement form signed by the employee

- Settlement letter with component-wise breakup

- Payslip showing final settlement details

- Tax deduction statement reflecting income tax

Without documentation, disputes become complex.

Full and Final Settlement Letter: Why It Matters

A settlement letter is not optional. It is proof.

For employees, the settlement letter confirms what was paid and why. For employers, it is protection against future claims and disputes. This letter should follow a clear format and show all components, deductions, and net final payment.

It must also include the last working date and settlement timeline details. If the letter is unclear, it can create dissatisfaction and legal risks.

What a Proper Settlement Letter Must Include

- Employee details, last working date, and settlement date are clearly

- Key component breakup showing earnings, deductions, and the total amount

- Leave encashment calculation with formula and final value shown

- Applicable taxes listed with deductions and supporting explanation

- Final settlement payment confirmation with payment reference and date

Tax Deductions in FnF: Income Tax, TDS, and Applicable Taxes

Tax deductions create the first argument in many FnF cases. Employees often feel deductions look high. Employers often face legal risks if TDS is missed.

The right approach is transparent calculation. Tax must be applied to taxable components under the income tax rules. Some components may be exempt depending on eligibility and limits.

FnF should never rely on guesses. It must use updated rules, employee declarations, and proof of availability.

What Tax Deductions Typically Apply To

- Income tax applies on taxable salary and incentive components

- Applicable taxes depend on the employee’s tax declaration and proofs

- TDS is deducted based on the settlement date and the total income

- Tax calculation must follow the legally required rules and the stipulated period

- Clear communication reduces arguments and helps employees accept deductions

External reference: Income Tax Department India portal.

Settlement Timeline and Legal Expectations

FnF is time sensitive.

Delays increase legal risks and employee dissatisfaction.

Settlement Timeline Rules

- Final payment must occur within the stipulated period

- Delay may violate labor laws

- The employer must communicate the expected settlement date

Clear communication reduces friction.

Employer Perspective: Why FnF Accuracy Is Critical

For employers, FnF is a risk control process.

Errors can result in disputes, audits, and penalties.

Employer Responsibilities in FnF

- Ensure all financial obligations are settled accurately

- Follow labor laws and company policies strictly

- Maintain proper documentation for audit defense

- Communicate clearly with the exiting employee

FnF directly impacts employer reputation.

Employee Perspective: Rights and Responsibilities

Employees also play a role in smooth settlement.

Understanding rights helps avoid misunderstandings.

Employee Responsibilities During Exit

- Serve notice period as per the employment agreement

- Submit claims and documents before the exit date

- Return company assets during the exit process

- Review settlement details before acceptance

Prepared employees face fewer disputes.

Common FnF Mistakes That Create Disputes

Most disputes arise from avoidable errors.

Frequent Errors in Final Settlement

- Incorrect leave balances due to attendance mismatches

- Wrong notice period deductions applied

- Missing tax deductions causing later liabilities

- Incomplete documentation is delaying final payment

Each mistake compounds legal risk.

How Clearances Work in FnF: People, Process, and Protocol

The FnF settlement process is not only a payroll task. It is a cross-team process.

Clearances are the gate that controls the final settlement payment. One missing clearance can delay payment beyond the stipulated period, which increases legal risks and damages the employer’s reputation.

Both employees and employers benefit when the protocol is clear. Employees know what is pending. Employers keep control of financial obligations and asset recovery.

Who Does What During Clearances

- HR verifies employee leaves, notice period, and exit process

- The finance department checks reimbursement claims, loans, and recoverable

- IT confirms asset returns and revokes system access securely

- Payroll team finalizes components, taxes, and settlement letter format

- Manager confirms handover completion and outstanding work closure

How to Keep Clearances Smooth

- Use clear communication across teams during the settlement timeline

- Track each clearance step with date, owner, and status

- Ensure proper documentation is collected before final payment release

- Resolve disputes quickly using a structured process and written proofs

- Confirm the settlement amount only after all clearances are completed

Mistakes That Can Derail Your Final Settlement

Most FnF delays do not happen because the rules are unclear. They happen because the data and process do not match.

From the employee side, missing documents and unclear claims create delays. From the employer side, calculation mistakes and poor coordination create disputes and legal exposure.

These issues are avoidable with the right combination of policy, process, and automation.

Common FnF Mistakes That Create Disputes

- Wrong leave balances create disputes and delay settlement completion

- Incorrect notice period deductions trigger employee dissatisfaction and arguments

- Missing TDS entries increase legal risks under income tax

- Unverified reimbursement claims delay final settlement payment processing

- The settlement letter lacks clarity and creates future claims risk

Prevention Checklist for Employers

- Validate attendance data before calculating unpaid salary and pending salaries.

- Test the calculation formula for each component using a sample example

- Maintain proper documentation for each deduction and payout decision

- Follow the full and final settlement rules within the stipulated period strictly

- Ensure finance department approvals match payroll settlement output exactly

How Bharat Payroll Simplifies Full and Final Settlement

FnF is complex when handled manually.

Bharat Payroll automates the entire process.

- Attendance data flows directly into settlement calculations

- Leave encashment computed using policy-based rules

- Applicable taxes calculated using updated income tax data

- Settlement letters generated automatically

Automation eliminates guesswork.

Why Employers Trust Bharat Payroll for FnF

Bharat Payroll supports compliance and accuracy.

- Reduces legal risks through rule-based processing

- Ensures settlements occur within the stipulated period

- Maintains audit-ready documentation always

- Improves employer reputation through fair exits

Exits become controlled and professional.

Why Employees Benefit from Automated FnF

Employees gain clarity and confidence.

- Transparent settlement structure prevents confusion.

- Accurate calculations reduce disputes

- Faster payment ensures a smooth exit experience

- Clear communication builds trust

Closure feels fair.

Final Thoughts: FnF Is the Last Professional Impression

Full and final settlement is not just a payment.

It is the final chapter of employment.

Handled poorly, it creates arguments and legal exposure.

Handled correctly, it delivers closure and respect.

With Bharat Payroll, employers meet compliance requirements and employees receive what they are legally entitled to — accurately, transparently, and on time.

Don’t risk disputes. Automate your full and final settlement with Bharat Payroll.

Simplify Full and Final Settlements Without Errors or Delays

Automate compliant full and final settlements with accurate calculations, timely payments, and clear documentation using Bharat Payroll.

Frequently Asked Questions

1. What is a full and final settlement in payroll?

Full and final settlement is the process of clearing all financial dues when employment ends. It includes unpaid salary, leave encashment, deductions, taxes, and benefits. Employers must complete it within the stipulated period to ensure legal compliance and avoid disputes.

2. What are the full and final settlement rules in India?

Full and final settlement rules in India are governed by labor laws like the Payment of Wages Act, Income Tax Act, EPF Act, and Gratuity Act. Employers must pay dues within legally defined timelines and maintain proper documentation for compliance.

3. What components are included in the final settlement payment?

Final settlement payment includes unpaid salary, leave encashment, bonuses if applicable, reimbursements, gratuity, provident fund handling, notice period adjustments, and applicable tax deductions. The total amount depends on company policies, employee tenure, and statutory rules.

4. How long can an employer take to process the FNF settlement?

Employers must process the FnF settlement within a stipulated period, typically between two and forty-five days, depending on exit type. Delays beyond this timeline may create legal risks, employee dissatisfaction, and potential penalties under Indian labor laws.

5. How does Bharat Payroll help with full and final settlement?

Bharat Payroll automates the FnF settlement process by linking attendance, payroll, tax rules, and documentation. It ensures accurate calculations, timely payments, legal compliance, and transparent settlement letters, reducing disputes for both employers and employees.