Understanding your salary is important for financial planning. Many employees search for what a pay stub is or what a payroll check stub is because they want a clear view of their earnings. A pay stub explains how your employer calculates your salary, how much tax was deducted, and how much money you finally receive.

Today, most companies prefer digital payroll. Many Indian businesses now use Bharat Payroll to generate accurate pay stubs, manage statutory deductions, and share salary details with employees simply and securely. This guide will help you understand everything about pay stubs, why they matter, and how they make payroll easier.

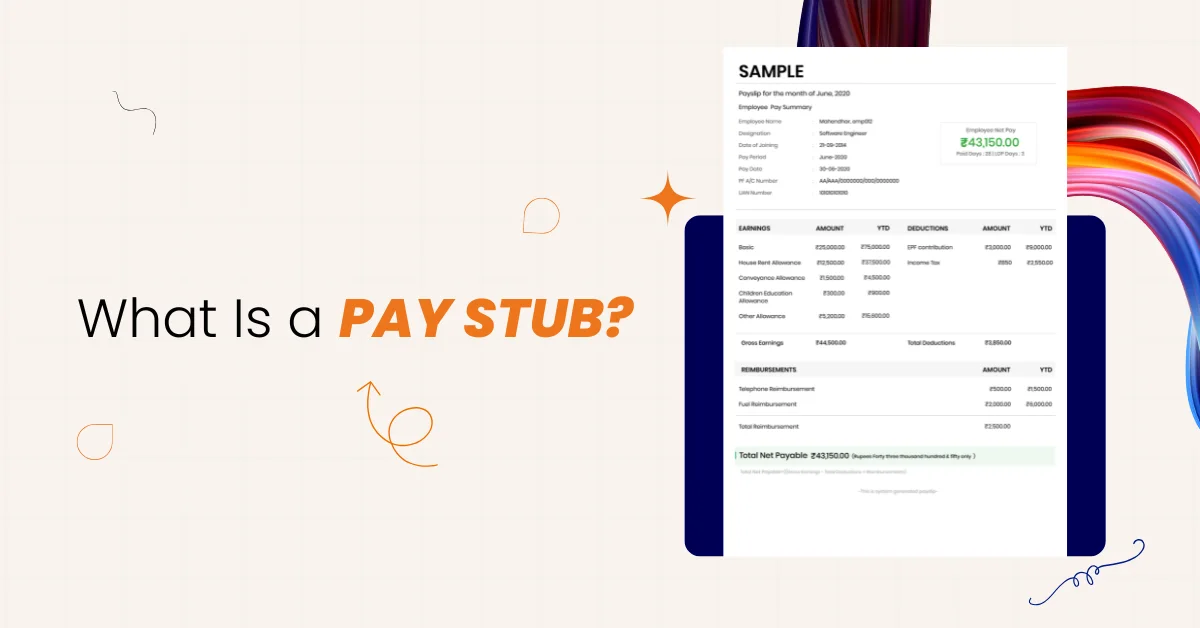

1. What Is a Pay Stub?

A pay stub is a document that shows how much an employee earned during a pay period and how much was deducted before they received their net pay. Some people call it a pay slip, paycheck stub, or employee’s pay stub, but all terms mean the same thing.

A pay stub includes:

- It shows the employee’s gross pay for the pay period before deductions.

- It lists income tax, professional tax, provident fund, and other deductions.

- It displays overtime pay, paid time hours, and the number of hours worked.

- It explains how much money was deposited into the employee through direct deposit.

- It provides clear details of employer contributions, such as PF or insurance.

Pay stubs act as a financial record and provide proof of income for banks, rental agreements, and tax returns.

2. Why Pay Stubs Are Important

Pay stubs help employees understand how their salary is calculated. They also help employers keep accurate payroll records. A clear pay stub protects both parties and reduces disputes.

Here’s why pay stubs matter:

- A pay stub shows the employee’s earnings and all payroll deductions clearly.

- It explains gross income and final take-home salary in a simple layout.

- It helps employees track tax withholdings and contributions to retirement plans.

- It works as proof of income when applying for loans or government benefits.

- It supports compliance with local wage and hour laws and payroll rules.

- It reduces payroll errors because all salary details are written in one place.

Most pay stubs include all information required for calculations, making payroll transparent and trustworthy.

3. Gross Pay vs Net Pay

Understanding the difference between gross pay and net pay helps employees read their pay stubs better.

i. Gross Pay

Gross pay is the total earnings before tax. It includes basic salary, overtime pay, bonuses, and any special allowances.

ii. Net Pay

Net pay is the final salary the employee receives after all taxes and deductions. This is also called take-home pay.

A pay stub displays both values to show how the final number was calculated.

4. What a Pay Stub Shows

A pay stub usually contains several important sections. Each one helps employees understand how the salary was processed.

i. Employee Details

A pay stub lists the employee’s name, employee ID, department, and tax identification details. This ensures payroll accuracy.

ii. Pay Period Details

It shows the beginning and end dates for the pay period. This helps employees match salary dates with their working days.

iii. Gross Earnings Section

This section contains the employee’s gross wages, overtime, and total hours worked. It explains how earnings before deductions were calculated.

iv. Payroll Deductions Section

This includes:

- Income tax

- Provident fund contributions

- Insurance premiums

- Professional tax

- Child support deductions

- Loan deductions

- Health insurance contributions

These deductions are required by law or company policy.

v. Employer Contributions Section

Some employers contribute to PF, insurance, or other benefits. Pay stubs show these values to highlight the total compensation package.

vi. Net Pay Section

This shows how much salary is transferred to the employee after deductions.

vii. Year-to-Date Summary

Many pay stubs display how much money the employee earned from January to the current month.

Pay stubs make it easy for employees to track income, check calculations, and manage personal finances.

5. Paper Pay Stubs vs Electronic Pay Stubs

Today, most companies use electronic pay stubs because they are fast, secure, and easy to access.

i. Printed Pay Stubs

Printed pay statements were common earlier. Employees received physical pay slips with their salary. Many small businesses still use this method.

ii. Electronic Pay Stubs

Digital pay stubs are now the preferred option. Employees can open them through an online portal or email. They help employees access pay stubs anytime during the tax season or while applying for loans.

Why Digital Pay Stubs Are Better

- They reduce paper use and save costs.

- They prevent loss of important pay information.

- They improve payroll accuracy and reduce errors.

- They help employees download pay stubs anytime for tax returns.

Platforms like Bharat Payroll make digital pay stub generation easy and secure.

6. Legal Requirements for Pay Stubs

Different regions follow different rules about pay stubs. Some laws require employers to provide pay stubs. Some laws do not require it, but encourage clear payment records.

Even when not required, pay stubs help businesses stay compliant with:

- Wage and hour laws

- Tax filing rules

- Employment tax records

- Proof of payment for employees

Accurate pay stubs help avoid costly mistakes during audits and inspections.

7. How a Pay Stub Helps Employees

Pay stubs help employees stay informed and in control of their finances.

Here’s how:

- They help employees confirm hours worked and overtime pay.

- They help employees track tax withholdings and insurance deductions.

- They support budget planning for each pay period.

- They assist in filing tax returns with accurate income information.

- They act as income proof for housing, banking, and loan applications.

A pay stub shows every salary detail that employees need to stay financially organized.

8. How a Pay Stub Helps Employers

Employers benefit from pay stubs because they keep payroll transparent and error-free.

Benefits include:

- They help reduce salary disputes by showing all details clearly.

- They simplify tax calculations and payroll reporting.

- They support compliance with government rules and wage laws.

- They keep payroll clean and easy to audit.

- They help employers manage salary structures for hourly workers and salaried employees.

Clear pay stubs show professionalism and improve trust between employers and employees.

9. The Role of Payroll Software in Pay Stub Creation

Manual payroll takes time and increases the risk of mistakes. Payroll software like Bharat Payroll simplifies everything.

How Payroll Software Helps

- It calculates hours, overtime, and gross earnings automatically.

- It detects payroll errors before processing.

- It applies tax laws correctly based on location and salary.

- It creates pay stubs with accurate details in seconds.

- It helps employees access their pay stubs through an online portal.

Payroll software ensures salary accuracy every time.

Conclusion

A pay stub is one of the most important salary documents for employees and employers. It explains earnings, deductions, taxes, and net pay in a simple format. Understanding what a pay stub is helps employees plan their finances better and avoid confusion.

Bharat Payroll makes pay stubs easy to generate, easy to access, and easy to understand. With automated payroll and secure digital slips, businesses save time and stay compliant.

Try Bharat Payroll for Pay Stub Automation

Bharat Payroll automates pay stubs, taxes, and salary details—keeping payroll clean and compliant.

FAQs

1) Why are pay stubs important for employees?

Pay stubs help employees understand how their salary was calculated each month. They show gross pay, net pay, deductions, and taxes. Employees use pay stubs for proof of income, loan applications, tax returns, and personal budgeting. Clear pay stubs help avoid confusion and build trust.

2) What details appear on a pay stub?

A pay stub shows employee details, pay period dates, gross earnings, hours worked, tax withholdings, deductions, employer contributions, and final take-home pay. It also displays year-to-date totals. These details help employees verify their income and ensure accurate payroll processing.

3) Are digital pay stubs valid for official use?

Yes. Digital pay stubs are widely accepted by banks, financial institutions, and government offices. They contain the same information as physical pay slips. Electronic pay stubs are safer, easier to access, and help employees manage salary documents during tax filing and financial checks.

4) How does Bharat Payroll help with pay stubs?

Bharat Payroll automatically generates accurate pay stubs using employee data, attendance, salary structure, and deductions. Employees can download pay stubs anytime through a secure portal. The software helps HR teams avoid mistakes and process payroll quickly and professionally.

5) What should employees check on their pay stubs?

Employees should review hours worked, overtime pay, gross earnings, tax deductions, PF, insurance amounts, and net pay. They should confirm whether contributions and deductions match their salary structure. Checking pay stubs regularly prevents errors and helps maintain clean financial records.